Jordan's King Abdullah II speaks during a meeting with tribal leader in Al-Qasta, south of Amman, Jordan, Monday, Oct. 4, 2021. King Abdullah II denied Monday any impropriety in his purchase of luxury homes abroad, an effort to contain a budding scandal over reports of lavish spending at a time when he has sought international aid to pull his impoverished country out of recession and help it cope with soaring unemployment. (Yousef Allan/The Royal Hashemite Court via AP)

The Associated Press

WASHINGTON (AP) - Calls grew Monday for an end to the financial secrecy that has allowed many of the world's richest and most powerful people to hide their wealth from tax collectors.

The outcry came after a report revealed the way that world leaders, billionaires and others have used shell companies and offshore accounts to keep trillions of dollars out of government treasuries over the past quarter-century, limiting the resources for helping the poor or combating climate change.

The report by the International Consortium of Investigative Journalists brought promises of tax reform and demands for resignations and investigations, as well as explanations and denials from those targeted.

The investigation, dubbed the Pandora Papers, was published Sunday and involved 600 journalists from 150 media outlets in 117 countries.

Hundreds of politicians, celebrities, religious leaders and drug dealers have used shell companies or other tactics to hide their wealth and investments in mansions, exclusive beachfront property, yachts and other assets, according to a review of nearly 12 million files obtained from 14 firms located around the world.

'œThe Pandora Papers is all about individuals using secrecy jurisdictions, which we would call tax havens, when the goal is to evade taxes,'' said Steve Wamhoff, director of federal tax policy at the left-leaning Institute on Taxation and Economic Policy in Washington.

The tax dodges can be legal.

Gabriel Zucman, a University of California, Berkeley, economist who studies income inequality and taxes, said in a statement one solution is 'œobvious'': Ban 'œshell companies - corporations with no economic substance, whose sole purpose is to avoid taxes or other laws.''

'œThe legality is the true scandal,'' activist and science-fiction author Cory Doctorow wrote on Twitter. 'œEach of these arrangements represents a risible fiction: a shell company is a business, a business is a person, that person resides in a file-drawer in the desk of a bank official on some distant treasure island.''

The more than 330 current and former politicians identified as beneficiaries of the secret accounts include Jordan's King Abdullah II, former U.K. Prime Minister Tony Blair, Czech Republic Prime Minister Andrej Babis, Kenyan President Uhuru Kenyatta, Ecuador's President Guillermo Lasso, and associates of both Pakistani Prime Minister Imran Khan and Russian President Vladimir Putin.

Some of those targeted strongly denied the claims.

Oxfam International, a British consortium of charities, applauded the Pandora Papers for exposing brazen examples of greed that deprived countries of tax revenue that could be used to finance programs and projects for the greater good.

'œThis is where our missing hospitals are," Oxfam said in a statement. 'œThis is where the pay-packets sit of all the extra teachers and firefighters and public servants we need."

The European Commission, the 27-nation European Union's executive arm, said in response to the revelations that it is preparing new legislative proposals to enhance tax transparency and reinforce the fight against tax evasion.

The Pandora Papers are a follow-up to a similar project released in 2016 called the 'œPanama Papers" compiled by the same journalistic group.

The latest bombshell is even more expansive, relying on data leaked from 14 different service providers doing business in 38 different jurisdictions. The records date back to the 1970s, but most are from 1996 to 2020.

The investigation dug into accounts registered in familiar offshore havens, including the British Virgin Islands, Seychelles, Hong Kong and Belize. But some were also in trusts set up in the U.S., including 81 in South Dakota and 37 in Florida.

The document trove reveals how powerful people are able to deploy anonymous shell companies, trusts and other artifices to conceal the true owners of corrupt or illicit assets. Legally sanctioned trusts, for example, can be subject to abuse by tax evaders and fraudsters who crave the privacy and autonomy they offer compared with traditional business entities.

Shell companies, a favored tax evasion vehicle, are often layered in complex networks that conceal the identity of the beneficial owners of assets - those who ultimately control an offshore company or other asset, or benefit from it financially, while other people's names are listed on registration documents. The report said, for example, that an offshore company was used to buy a $4 million Monaco apartment for a woman who reportedly carried on a secret relationship with Putin.

While a beneficial owner may be required to pay taxes in the home country, it's often difficult for authorities to discover that an offshore account exists, especially if offshore governments don't cooperate.

A Treasury Department agency working on new regulations for a U.S. beneficial ownership directory has been debating whether partnerships, trusts and other business entities should be included. Transparency advocates say they must or else criminals will devise new types of paper companies for slipping through the cracks.

International bodies like the G7 group of wealthiest nations and the Financial Action Task Force have begun initiatives in recent years to improve ownership transparency, but the efforts have moved at a modest pace.

Pointing to the secrecy behind many of the tax dodges, some critics are calling for a global wealth registry that would make sham investments in shell companies public, embarrassing politicians or celebrities worried about their reputations.

In the U.S., the House passed legislation this summer that would require multinational corporations to publicly disclose their tax payments and other key financial information on a country-by-country basis. Anti-money laundering and corporate transparency measures were tucked into legislation funding the Defense Department; it has yet to be implemented by the Treasury Department.

The Biden administration is also pushing for U.S banks to be required to report customers' account information to the IRS as part of the $3.5 trillion economic and social spending package before Congress. Treasury Secretary Janet Yellen and other officials say it's an important way to prevent tax dodging by wealthy individuals and companies, but it has raised fierce opposition from banking industry groups and Republican lawmakers, who maintain it would violate privacy and create unfair liability for banks.

Tax havens have already come under considerable scrutiny this year.

In July, negotiators from 130 countries agreed to a global minimum tax of at least 15% to prevent big multinational corporations from minimizing taxes by shifting profits from high- to low-tax jurisdictions such as Bermuda and the Cayman Islands. Details of the plan by the Paris-based Organization for Economic Cooperation and Development, have yet to be worked out; it's supposed to take effect in 2023.

And while the plan would cover huge multinational corporations, it would not include the shell companies and other entities behind the schemes described in the Pandora Papers.

___

Associated Press writers Stan Choe in New York and John Rice in Mexico City contributed to this report.

Chilean President Sebastian Piñera gives a press conference at La Moneda presidential palace in Santiago, Chile, Monday, Oct. 4, 2021. Piñera is one of hundreds of current and former politicians identified as beneficiaries of secret offshore bank accounts to hide their investments and shield assets, according to the International Consortium of Investigative Journalists in a global report released on Oct. 3, 2021, dubbed the "Pandora Papers." (AP Photo/Esteban Felix)

The Associated Press

Kenya's President Uhuru Kenyatta speaks behind bulletproof glass at the inauguration ceremony of Ethiopia's Prime Minister Abiy Ahmed, after Abiy was sworn in for a second five-year term, in the capital Addis Ababa, Ethiopia Monday, Oct. 4, 2021. Calls grew Monday for an end to the financial secrecy and shell companies that have allowed many of the world's richest and most powerful people to hide their wealth from tax collectors, following a report by the International Consortium of Investigative Journalists, with Kenya's President Uhuru Kenyatta one of 330 current and former politicians identified as beneficiaries of the secret accounts. (AP Photo/Mulugeta Ayene)

The Associated Press

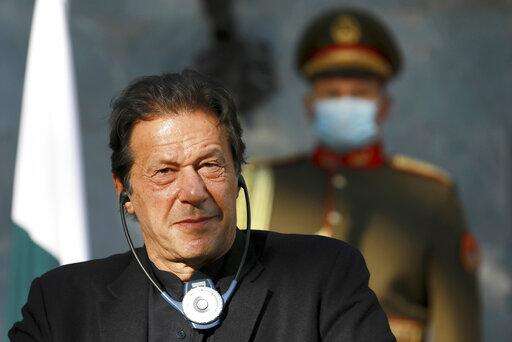

FILE - In this Nov. 19, 2020 file photo, Pakistan Prime Minister Imran Khan speaks during a joint news conference with Afghan President Ashraf Ghani (not shown) at the Presidential Palace in Kabul, Afghanistan. Hundreds of world leaders, powerful politicians, billionaires, celebrities, religious leaders and drug dealers have been stashing away their investments in mansions, exclusive beachfront property, yachts and other assets for the past quarter century, according to a review of nearly 12 million files obtained from 14 different firms located around the world. The report released Sunday, Oct. 3, 2021 by the International Consortium of Investigative Journalists involved 600 journalists from 150 media outlets in 117 countries. Pakistan Prime Minister Imran Khan is one of 330 current and former politicians identified as beneficiaries of the secret accounts.(AP Photo/Rahmat Gul, File)

The Associated Press

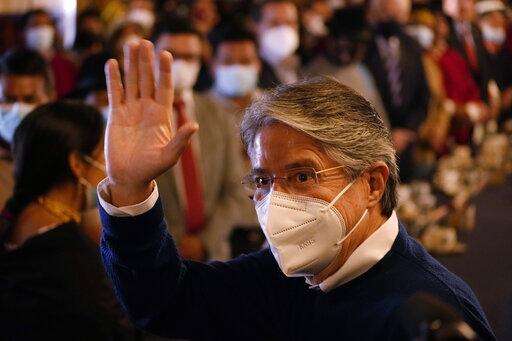

Ecuador's President Guillermo Lasso waves as he arrives to meet with Indigenous groups at the government palace in Quito, Ecuador, Monday, Oct. 4, 2021. Lasso is one of hundreds of current and former politicians identified as beneficiaries of secret offshore bank accounts shielding assets, according to the International Consortium of Investigative Journalists in a global report released on Oct. 3, 2021, dubbed the "Pandora Papers." (AP Photo/Dolores Ochoa)

The Associated Press

An exterior view of 56-60 Conduit Street in the Mayfair district of London, Monday, Oct. 4, 2021. The property is linked to Azerbaijani President Ilham Aliyev in a new report dubbed the Pandora Papers that sheds light on how world leaders, powerful politicians, billionaires and others have used offshore accounts to shield assets collectively worth trillions of dollars over the past quarter-century. (AP Photo/Matt Dunham)

The Associated Press

A view of the entrance of the Chateau Bigaud, in Mougins, southern France, Monday, Oct. 4, 2021. An investigation found that in 2009, Andrej Babis, the Czech prime minister, put $22 million into shell companies to buy the property near Cannes. The shell companies and the chateau were not disclosed in Babis' required asset declarations, according to documents obtained by the journalism group's Czech partner, Investigace.cz. (AP Photo/Daniel Cole)

The Associated Press

FILE - Russian President Vladimir Putin chairs a Security Council meeting via video conference at the Novo-Ogaryovo residence outside Moscow, Russia, in this Monday, Sept. 27, 2021, file photo. Hundreds of world leaders, powerful politicians, billionaires, celebrities, religious leaders and drug dealers have been stashing away their investments in mansions, exclusive beachfront property, yachts and other assets for the past quarter century, according to a review of nearly 12 million files obtained from 14 different firms located around the world. The report released Sunday, Oct. 3, 2021 by the International Consortium of Investigative Journalists involved 600 journalists from 150 media outlets in 117 countries. Russian President Vladimir Putin is one of 330 current and former politicians identified as beneficiaries of the secret accounts. (Alexei Druzhinin, Sputnik, Kremlin Pool Photo via AP, File)

The Associated Press

FILE - In this May 10, 2021, file photo released by Russian Foreign Ministry Press Service, Azerbaijani President Ilham Aliyev speaks to Russian Foreign Minister Sergey Lavrov during their meeting in Baku, Azerbaijan. Hundreds of world leaders, powerful politicians, billionaires, celebrities, religious leaders and drug dealers have been stashing away their investments in mansions, exclusive beachfront property, yachts and other assets for the past quarter century, according to a review of nearly 12 million files obtained from 14 different firms located around the world. The report released Sunday, Oct. 3, 2021 by the International Consortium of Investigative Journalists involved 600 journalists from 150 media outlets in 117 countries. Azerbaijani President Ilham Aliyev is one of 330 current and former politicians identified as beneficiaries of the secret accounts. (Russian Foreign Ministry Press Service via AP, File)

The Associated Press

FILE In this file photo taken on Thursday, March 16, 2017, Head of Russian First Channel Konstantin Ernst attends a meeting in Moscow, Russia. Hundreds of world leaders, powerful politicians, billionaires, celebrities, religious leaders and drug dealers have been stashing away their investments in mansions, exclusive beachfront property, yachts and other assets for the past quarter century, according to a review of nearly 12 million files obtained from 14 different firms located around the world. The consortium of journalists revealed Putin's image-maker and chief executive of Russia's leading TV station, Konstantin Ernst, got a discount to buy and develop Soviet-era cinemas and surrounding property in Moscow after he directed the 2014 Winter Olympics in Sochi. Ernst told the organization the deal wasn't secret and denied suggestions he was given special treatment. (AP Photo/Alexander Zemlianichenko, File)

The Associated Press

FILE - Former British Prime Minister Tony Blair is shown ahead of a meeting at the EU Charlemagne building in Brussels, in this Wednesday, Nov. 6, 2019, file photo. Hundreds of world leaders, powerful politicians, billionaires, celebrities, religious leaders and drug dealers have been stashing away their investments in mansions, exclusive beachfront property, yachts and other assets for the past quarter century, according to a review of nearly 12 million files obtained from 14 different firms located around the world. The report released Sunday, Oct. 3, 2021, by the International Consortium of Investigative Journalists involved 600 journalists from 150 media outlets in 117 countries. Former British Prime Minister Tony Blair is one of 330 current and former politicians identified as beneficiaries of the secret accounts. (Stephanie Lecocq/Pool via AP, File)

The Associated Press

FILE In this file photo taken on Wednesday, Sept. 1, 2021, Ukrainian President Volodymyr Zelenskyy speaks as he meets with President Joe Biden in the Oval Office of the White House, in Washington. Hundreds of world leaders, powerful politicians, billionaires, celebrities, religious leaders and drug dealers have been stashing away their investments in mansions, exclusive beachfront property, yachts and other assets for the past quarter century, according to a review of nearly 12 million files obtained from 14 different firms located around the world. The report released Sunday, Oct. 3, 2021 by the International Consortium of Investigative Journalists involved 600 journalists from 150 media outlets in 117 countries. (AP Photo/Evan Vucci, File)

The Associated Press